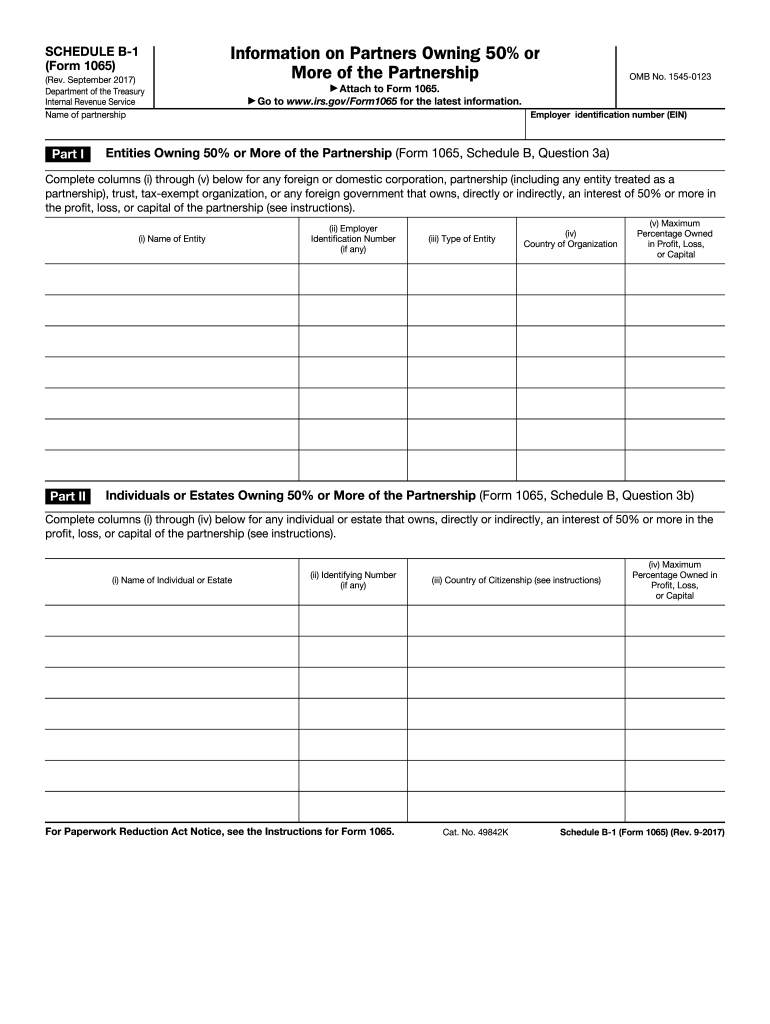

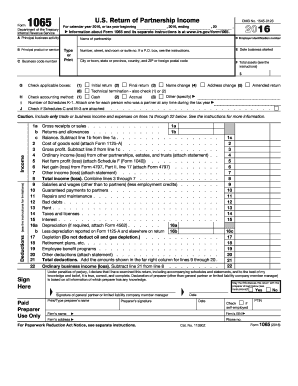

Who Needs Schedule B-1 Form 1065?

The given form is an Internal Revenue Service document, that is known as Information for Partners Owning 50% or More of the Partnership. It must be filled out by parties to the eligible partnership to inform the IRS of interest of 50% or more in the profit, loss, or capital owned by certain entities, individuals and estates.

What is Form 1065 Schedule B-1 for?

The form is required in order to provide the IRS with information about a partnership. A partnership a kind of relationship between two or more individuals who have agreed to jointly run a business, in with each person should contribute money, property, labor, or skill and each expects to split the profits and losses of the business.

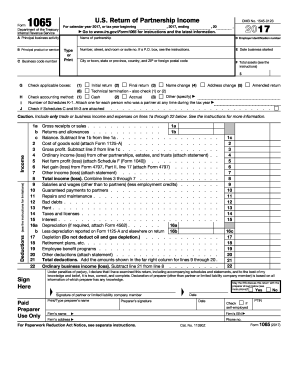

Is Schedule B-1 Accompanied by any Other Documents?

The given document serves as an accompaniment to Form 1065, that is why it must be submitted together with the Return of Partnership Income.

When is Form 1065 Schedule B-1 Due?

Schedule B-1 does not have its own due date, because it is a supplement to Form 1065. In its turn, Form 1065 must be filed by the 15h day of the third month following the end of the partnership’s fiscal year. If this day falls on a weekend or federal holiday, it is put off until the next business day.

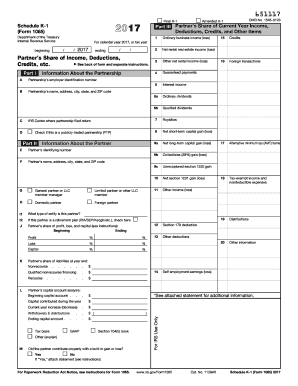

How do I Fill out Form 1065 Schedule B-1?

Basically, the schedule form asks only the details about the parties engaged in the partnership: entities, individuals and estates (names, identification numbers, countries of origin, maximum percentage owned in profit, loss, or capital).

Where do I send the completed Form 1065 Schedule B-1?

The filled out supplement (Schedule B-1) and the primary document (Form 1065) must be delivered to the local IRS office by the deadline.